Heritage.Engineered.

We are a systematic family office that manages capital with the speed of a machine and the stewardship of an owner.

Karanwal Capital was founded on a singular thesis: In the long run, systems outperform sentiment.

While traditional family offices rely on human intuition and outsourced managers, we took a different path. We built an internal quantitative infrastructure—rooted in Python, and Rust—to take absolute control of our financial destiny.

Managing over $25M+ in proprietary capital, we do not chase market trends. Instead, we architect automated strategies that harvest volatility, arbitrage inefficiencies, and compound wealth across decades. We are not just asset allocators; we are systems engineers building a fortress for generational capital.

The Hybrid Model: Where Code Meets Conviction

Our approach bridges two distinct worlds that rarely touch:

1. The Quantitative Engine : At our core, we operate like a technology firm. Our proprietary algorithms scan the top market indexes and Global Credit Markets in real-time. By utilizing mean-reversion logic and statistical arbitrage, we remove behavioral bias from the investment equation. If the model detects an edge, we execute—without hesitation.

2. The Family Mandate Unlike a hedge fund, we have no external investors to impress every quarter. This 'permanent capital' structure allows us to be radically patient. We can endure short-term drawdowns that force others to sell, effectively allowing us to buy liquidity when it is most expensive.

The Result: A portfolio that captures the upside of aggressive quant trading while maintaining the defensive bedrock required for multi-generational survival.

The Core Principles

Radical Alignment

We are not agents; we are principals. Every dollar deployed belongs to the family. There are no sales commissions, no hidden fees, and no conflict of interest. We eat our own cooking

Asymmetric Risk

We believe in convex returns: risking a little to make a lot. Whether in Venture Capital or Derivatives, we structure trades where the maximum loss is known, but the upside is uncapped

Syntax Over Sentiment

Markets are emotional; code is not. We adhere to strict algorithmic rules for entry, exit, and sizing. We do not rely on 'gut feeling'—we rely on backtested statistical probability.

Liquidity Preference

Wealth you cannot access is not wealth; it is a number on a screen. We prioritize highly liquid instruments (Public Equities, G-Secs) to ensure we remain agile during macro-economic pivots.

From the Desk of the CIO

Why We Built The Machine

To our partners and peers,

I founded Karanwal Capital to solve a specific problem: Human emotion is the greatest liability in investing.

In my early years trading, I realized that the market punishes intuition and rewards discipline. Yet, even the most disciplined investor hesitates when volatility spikes.

That is why we stopped 'guessing' and started 'building.'

We transformed Karanwal Capital from a traditional investment office into a quantitative infrastructure. We wrote the code, we built the data pipelines, and we defined the risk parameters. Today, we don't just allocate capital; we engineer its growth.

We are not here to chase the next hot trend. We are here to compound wealth across decades, protected by the certainty of mathematics.

Welcome to the new standard.

Bhanu Karanwal

Founder & Chief Investment Officer

Governance & Oversight

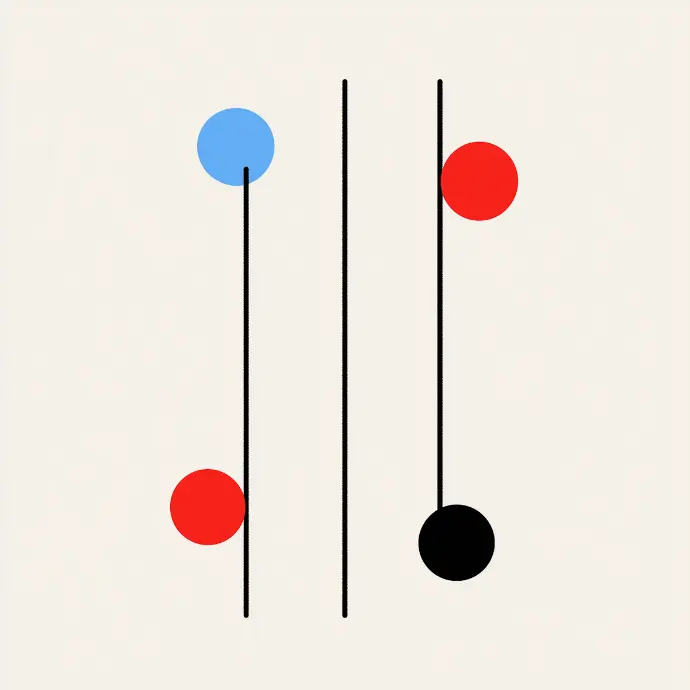

To ensure longevity, we separate decision-making into three independent silos

The Investment Committee

Capital Allocation

Sets the strategic mandate. Responsible for approving high-level asset allocation and vetting private market deals (Venture/Credit)

Risk Management Office

Capital Preservation

Operates independently from the trading desk. This function enforces strict drawdown limits and has veto power over any strategy that exceeds risk parameters

Quantitative Council

Model Validation

Responsible for the integrity of our code. Reviews backtest data, stress-tests algorithms, and approves updates to the Rust execution core

1. Hypothesis Generation

We do not guess market direction. Every strategy begins as a data-driven hypothesis. Our research team ingests terabytes of alternative data—from volatility surfaces to macro-economic indicators—to identify statistical anomalies that others miss

2. Stress Testing & Validation

Before a single dollar is deployed, the algorithm enters the 'Torture Chamber.' We simulate the strategy against historical crises (2008, 2020) and Monte Carlo scenarios to ensure it can survive extreme volatility without breaking

3. Low-Latency Execution

Once validated, the strategy is handed over to our Rust-based execution engine. It operates autonomously, routing orders to the exchange with sub-millisecond latency—removing human emotion and slippage from the equation

Proprietary Infrastructure

We do not rely on retail platforms. We build our own.

In high-frequency markets, latency is the difference between alpha and error. That is why we moved beyond standard broker terminals.

Karanwal Capital operates on a custom-built Direct Market Access (DMA) ecosystem. By writing our execution core in Rust (for safety and speed) and our research layer in Python (for data agility), we have achieved institutional-grade latency.

- Zero-Dependency: We own the code, the data pipelines, and the execution logic.

- Microsecond Execution: Our algorithms react to market depth changes faster than human reflexes allow.

- 24/7 Uptime: Automated sentinels monitor portfolio health around the clock, ensuring risk parameters are never breached.